.TV

Entering November, demand for TV panels has only slightly weakened, with some brands still willing to place orders. Meanwhile, certain panel makers, aiming to hit their annual targets, have made only minor adjustments to utilization rates while actively coordinating with brand demand. As the year-end approaches, most brands and panel makers have also begun discussions on next year’s plans. Panel makers have taken a more flexible stance and are therefore more willing to make concessions on pricing.

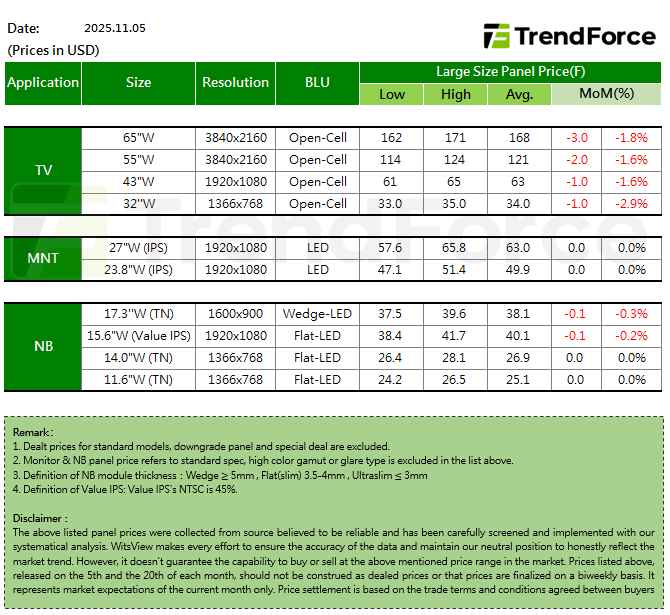

In terms of TV panel prices for November, 32-inch and 43-inch panels are expected to decline by US$1, 50-inch and 55-inch panels by US$2, and 65-inch and 75-inch panels by US$3.

.MNT

Demand for MNT panels has weakened notably in the fourth quarter. However, panel makers remain reluctant to cut prices, leading to continued losses. As a result, both buyers and sellers largely agree to keep prices stable. For November, prices of most mainstream sizes are expected to remain flat, except for the 23.8-inch VA Open Cell panel, where supply has slightly loosened and prices may drop by US$0.1.

.NB

With the arrival of November, despite the traditional off-season, notebook panel demand has been slightly stronger than expected, with some brands increasing orders while seeking price concessions. As year-end approaches, panel makers have taken a more flexible stance to maintain customer relationships, offering both hidden discounts and modest reductions in listed prices. In terms of November notebook panel prices, TN panel prices are expected to remain flat across the board, while IPS panel prices are projected to decline by US$0.1.

- CONTACT US

- sales@ic365buy.com

- +00852-6763-0779

- Feedback

- FOLLOW US

Smart-Core Cloud International Company Limited Copyright ©2019-2026 SMC All Rights Reserved