According to TrendForce’s latest memory spot price trend report, regarding DRAM, hedging demand against further price hikes has sparked a surge in DDR4 and DDR5 trading, with the average spot price of DDR4 1Gx8 3200 MT/s jumping 9.86% week-on-week. Meanwhile, NAND Flash prices continued to climb this week, with wafers across various capacities posting 15–20% average gains, driven by suppliers’ higher quotations. Details are as follows:

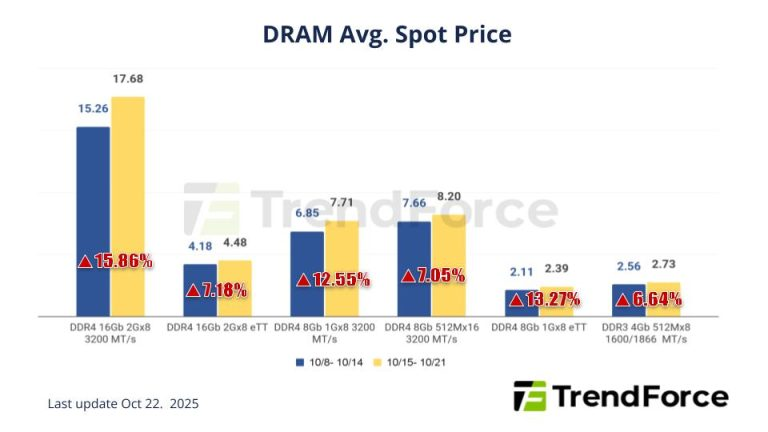

DRAM Spot Price:

In the spot market, trading momentum continues to gain strength, and the general market sentiment is bullish. Module houses with inventory are now holding back, further pushing prices up rapidly. From the buyers’ perspective, even though the demand for consumer electronics has not notably recovered, there is a strong incentive to maintain safe inventory levels due to expectations of large and ongoing price hikes. This demand, related to hedging the risk of price increases, has boosted transaction volumes for DDR4 and DDR5 products. Consequently, the spot market has become strong, showing rising prices and volumes. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has increased by 9.86% from US$7.219 last week to US$7.931 this week.

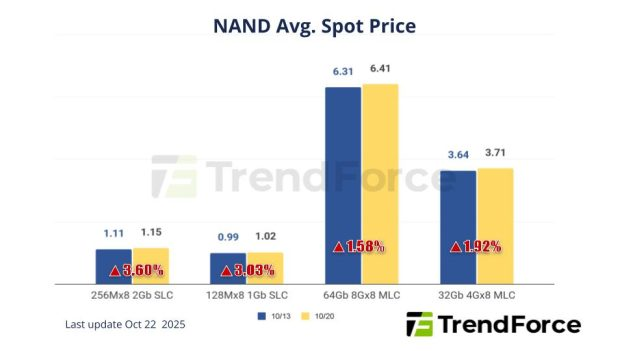

NAND Flash Spot Price:

The spot market of NAND Flash carries on with a strong increment this week, where overall market sentiment has elevated extensively. Wafers of various capacities have seen an average price increase of 15-20% as they continue to be affected by suppliers’ risen quotations. Among which, 512Gb and 1Tb TLC wafers are the most apparent in price hikes, and actual transactions remain relatively confined, despite buyers’ aggressiveness in raising their targeted prices. The supply end is generally reluctant in sales and controlling their stocks, with most quotations focusing on a high level, and low-priced sources are almost impossible to find. Due to low availability of spots, as well as the general market consensus on further room for increment in 4Q25, buyers are now leaning towards seizing products to preserve their inventory, which further intensified the constraints of spots. Spots of 512Gb TLC wafers rose by 27.96% this week, arriving at US$$4.576.

- CONTACT US

- sales@ic365buy.com

- +00852-6763-0779

- Feedback

- FOLLOW US

Smart-Core Cloud International Company Limited Copyright ©2019-2026 SMC All Rights Reserved