According to TrendForce’s latest memory spot price trend report, regarding DRAM, although spot transaction volumes keep shrinking, DDR4 prices have risen more than DDR5, showing that the impact of the DDR4 EOL announcements by the three major suppliers hasn’t fully faded. In terms of NAND, suppliers’ ongoing reduction of wafer availability this quarter forced spot sellers to refuse selling at lower prices. Details are as follows:

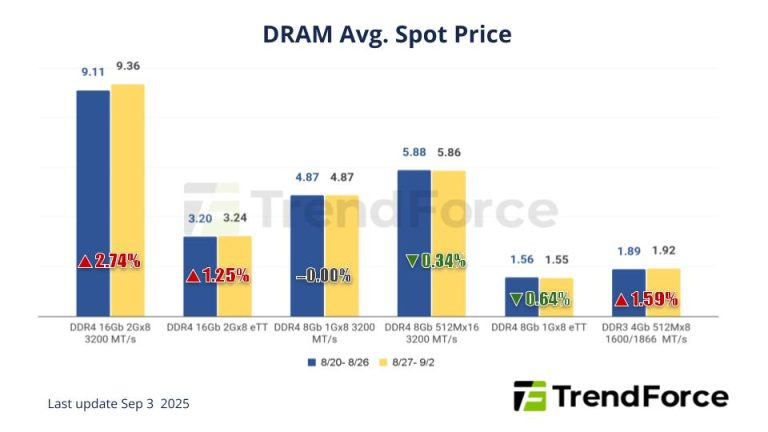

DRAM Spot Price:

The DRAM spot market was relatively quiet during August, with prices experiencing minor fluctuations but generally holding steady. Spot transaction volumes have continued to shrink, and there has been no signs of a notable demand rally. The price increase for DDR4 has generally been larger than that for DDR5, indicating that the impact of the DDR4 EOL announcements by the three major suppliers has not completely subsided. The average spot price of mainstream chips (i.e., DDR4 1Gx8 3200MT/s) has increased by 0.06% from US$4.875 last week to US$4.878 this week.

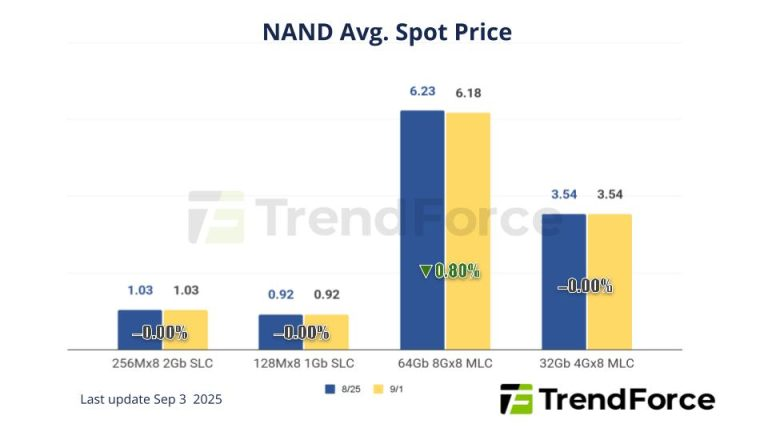

NAND Flash Spot Price:

Suppliers’ ongoing reduction of wafer availability this quarter forced spot sellers to refuse selling at lower prices, though transactions have been relatively confined, with no significant changes on prices. Spot price of 512Gb TLC wafers rose slightly by 0.11% this week, arriving at US$2.798.

- CONTACT US

- sales@ic365buy.com

- +00852-6763-0779

- Feedback

- FOLLOW US

Smart-Core Cloud International Company Limited Copyright ©2019-2026 SMC All Rights Reserved