Global smartphone shipments grew by a modest 2% YoY in Q2 2025, according to Counterpoint Research’s preliminary estimates from its Market Monitor service. The increase, which marked the second consecutive quarter of growth, was largely driven by the markets in North America, Japan and Europe.

Commenting on the market dynamics, Research Director Tarun Pathak said, “The earlier concerns around tariffs, which disrupted shipments in Q1, started to ease in the second quarter. Still, markets like China and North America continued to feel some impact, leading North America to stockpile shipments. Entry-level and budget 5G devices saw growing traction in emerging markets, while premium demand remained steady in mature markets.”

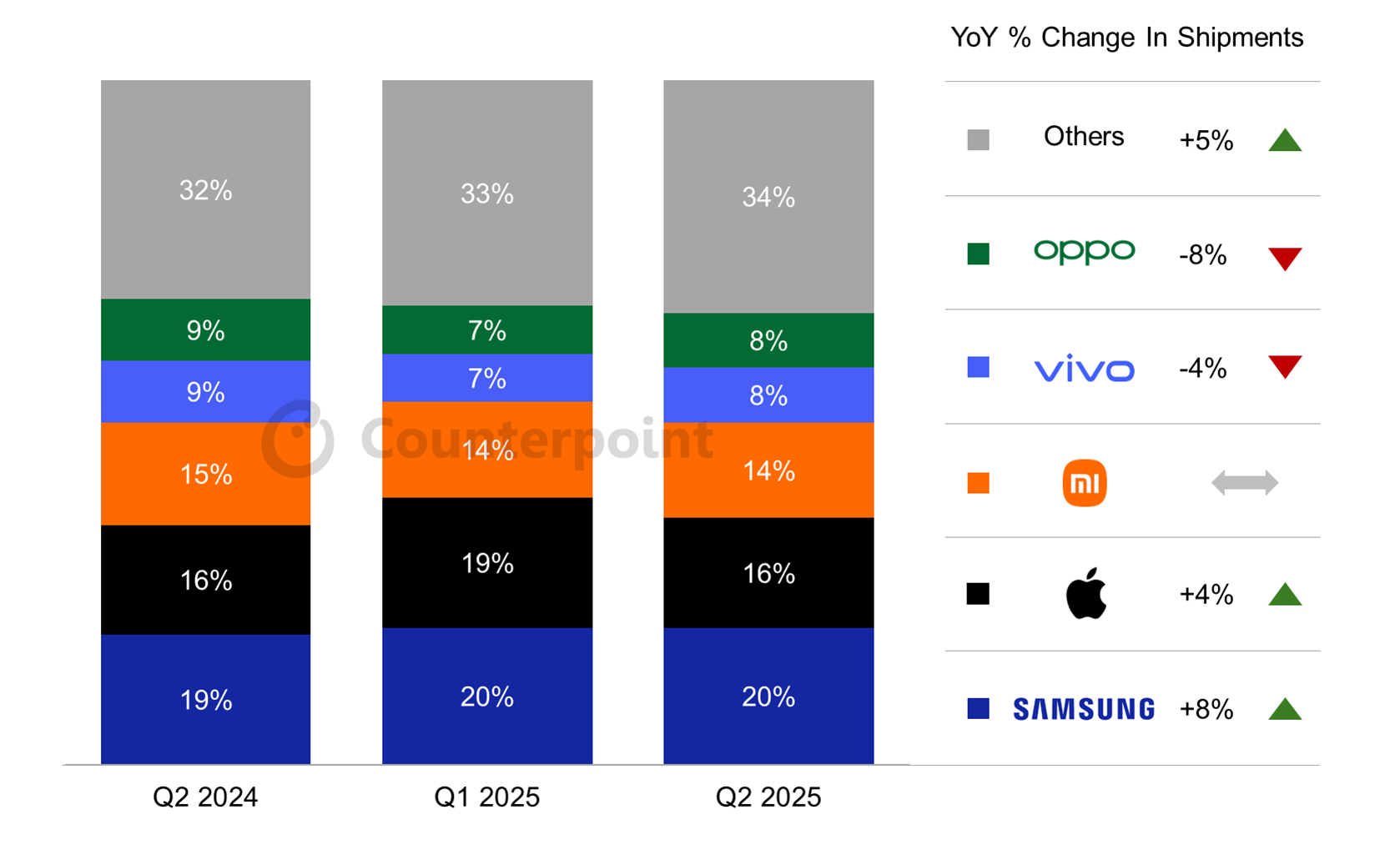

Commenting on OEM performance, Senior Analyst Shilpi Jain said, “Samsung maintained the first position in the global smartphone market in Q2 2025 while witnessing an 8% YoY growth in shipments. The growth, which followed a strong Q1 driven by the Galaxy S25 series, came on the back of mid-tier phones’ stabilizing performance across key markets, especially the A-series refresh. The company’s foldables and AI-led features helped retain brand stickiness.”

Apple remained in second place while recording a 4% YoY growth, driven by an early surge in demand ahead of the anticipated tariff impact in North America, along with strong performance in India and Japan. The iPhone 16 series, along with the iPhone 15 series, continued to see solid demand, helping Apple stay competitive. We expect Apple to keep this momentum in H2 as well with the expected launch of the iPhone 17 series and increasing focus on ecosystem product bundling.

Xiaomi stayed close behind in third place, with a flattish YoY performance in Q2 2025. The brand has witnessed strong demand in Central Europe and Latin America, while maintaining steady momentum in China. The brand’s consistent portfolio refresh and competitive pricing helped it maintain the momentum. Xiaomi’s performance was also supported by the success of its AI-integrated premium devices and wider adoption of HyperOS.

vivo and OPPO ranked fourth and fifth, respectively, with stable mid-tier segment performance and recovery signs in overseas markets like Latin America and the Middle East and Africa (MEA). OPPO strengthened its dominance in the entry-level segment with a solid performance of the A5 Pro, while vivo was supported by events like China’s 618 festival and strong mid-range performance in India, led by its Y and T series.

Motorola emerged as one of the fastest-growing major brands with a 16% YoY growth fueled by strong demand in India, continued expansion in North America's prepaid market and rising competitiveness in the mid-range 5G segment.

- CONTACT US

- sales@ic365buy.com

- +00852-6763-0779

- Feedback

- FOLLOW US

Smart-Core Cloud International Company Limited Copyright ©2019-2026 SMC All Rights Reserved