Where China stumbles, India rises; smartphone giants like Apple and Samsung are betting big on India as global production reportedly slows and supply chains shift in 2025.

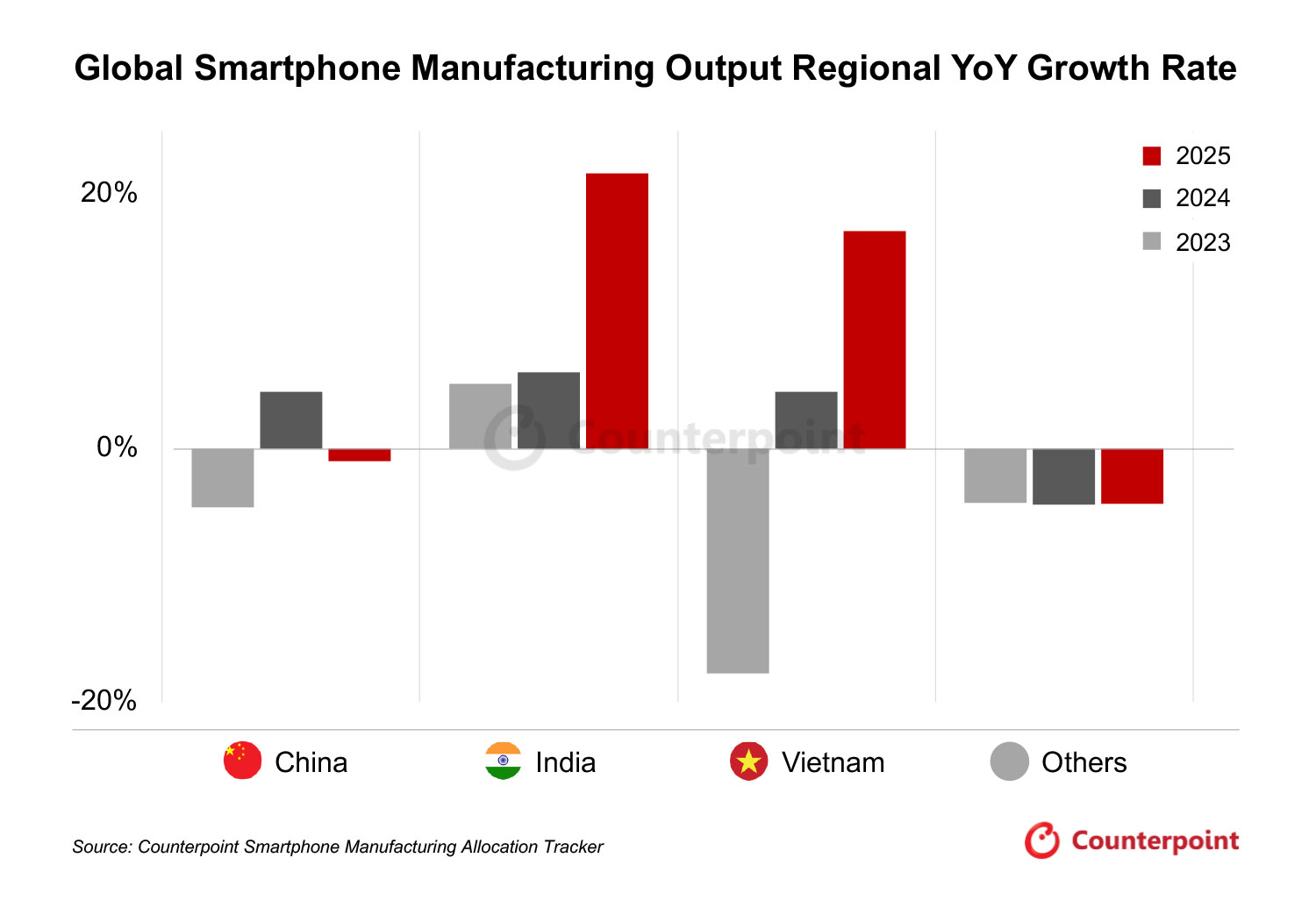

Global smartphone manufacturing is set to contract by 1% in 2025, following a 4% rise in 2024. The decline is driven by ongoing tariff pressures and an overall slowdown in the industry, according to Counterpoint Research’s report.

Notably, India is poised to benefit the most from this shift. The country is projected to post double-digit growth, boosting its global share of smartphone production to a record 20%. The surge is primarily driven by increased exports from global tech giants, including Apple and Samsung.

China, meanwhile, which held a dominant position in smartphone production, will experience a noticeable dip due to the direct impact of trade tariffs and reduced domestic demand.

The report highlighted that this underperformance is part of a broader global realignment in manufacturing locations.

Vietnam is also expected to perform well, maintaining its status as a key export hub. Strong manufacturing contributions from Samsung and Motorola are helping the country navigate industry challenges and attract relocated production from China.

Other regions, however, are likely to see further declines. These markets remain small players in global output and continue to struggle with localised demand constraints.

Commenting on the trend, Counterpoint Research analyst Ivan Lam noted that “tariffs have hit the entire supply chain, forcing brands to move out of China and seek more viable alternatives.”

He highlighted India and Vietnam as key beneficiaries due to their improving capabilities and proximity to supply networks.

India’s growth is supported by rising investment from global and local electronics manufacturing services (EMS) firms.

Analyst Prachir Singh said the country’s ecosystem has matured significantly over the past decade. Recent government initiatives, such as the Electronics Components Manufacturing Scheme (ECMS), are also helping to attract further investment.

“India’s overall manufacturing ecosystem is continuously growing, and local manufacturing is consistently improving, both in terms of yield and complexity,” he said.

Counterpoint VP Neil Shah, however, warned that relocating manufacturing operations is a complex, long-term process. He noted that producing an iPhone in the US could raise costs by up to 20% due to higher labour, logistics, and capital expenses.

Nevertheless, sespite short-term challenges, India is expected to remain a key winner in the shifting global smartphone manufacturing landscape.

- CONTACT US

- sales@ic365buy.com

- +00852-6763-0779

- Feedback

- FOLLOW US

Smart-Core Cloud International Company Limited Copyright ©2019-2026 SMC All Rights Reserved